HFM broker, which is a broker under the ownership of HF Markets Group, offers a wide range of different account types, giving traders a variety of options. Additionally, HFM broker boasts the widest selection of trading resources, including high-quality software. The broker prides itself on providing favorable trading conditions and prompt execution of orders.

Additionally, HFM broker offers a comprehensive suite of tools and services, ensuring that individuals can select the best option for their needs. The reliability of the broker is further strengthened by obtaining licenses from multiple regulatory bodies. With over a decade of experience in the financial, brokerage and other related services markets, HFM broker has built an impressive track record. During this time the company has been awarded 35 prestigious awards. Notably, HFM employs the popular MetaTrader 4 and MetaTrader 5 trading terminals for a seamless trading experience.

🏦 Min. Deposit | USD 0 |

🛡️ Regulated By | CySEC, FCA, DFSA, FSC |

💵 Trading Cost | USD 10 |

⚖️ Max. Leverage | 1000:1 |

💹 Copy Trading | ✅ |

🖥️ Platforms | MT4, MT5 |

💱 Instruments | Bonds, Commodities, Cryptocurrencies, Energies, Stock CFDs, ETFs, Forex, Indices, Metals, Stock DMAs |

Advantages of HFM | Disadvantages of HFM |

✅Founded in Cyprus and known for its update technology | ❌International offering done via offshore |

✅Regulated Financial Conduct Authority FCA, CySEC, South Africa etc | ❌Educational content could be improved |

✅Wide range of trading instruments, including forex, commodities, indices, and stocks | |

✅20 international awards | |

✅Multiple account types to suit different trading styles | |

✅Excellent customer support with 25 languages |

HFM Broker Licenses:

- HFM (Europe) Ltd – authorized by CySEC (Cyprus) registration number 183/12

- HF Markets Investments Ltd – authorized by CMA (Kenya) license number 155

- HF Markets (UK) Limited – authorized by FCA (UK) registration number 801701

- HFM (Seychelles) Ltd – authorized by FSA (Seychelles) registration number SD015

Overall Summary

Regulation

Beginner Friendly

Trading Conditions

Trading Platforms

Customer Service

Deposit & Withdrawal

Education & Research

Assets Available

Year Founded : 2010

Cryptocurrencies: (5+) Bitcoin, Litecoin, Ethereum

Deposit Methods: Local Deposit, Bank Wire (BankTransfer), VISA, MasterCard, Neteller, Skrill, WM, PM, Crypto, USDT (MORE)

HFM Company Details

Company Name:

Founded

Website

Website Language

Office Locations

HF Markets (SA) Ltd

2010

English, Chinese, Bangla, Hindi, Indonesian, Portuguese, Arabic, Japanese, Malay, Thai, Spanish

Dubai, UK, Seychelles, South Africa, Cyprus, Mauritius

What Is The Difference Between HotForex and HF Markets (HFM)?

HotForex and HF Markets (HFM) essentially refer to the same entity, with HotForex being the trading name used by the HF Markets Group. In other words, HotForex is a brand or a trading name under which the services of HF Markets Group are provided. Open an Account right now – Click Here

Is HFM safe for trading?

HFM broker is considered a safe broker for trading. It is regulated by two Tier-1 regulators (Financial Conduct Authority (FCA) and the European Union via MiFID), three Tier-2 regulators (CySEC, ASIC, and SCB), and one Tier-4 regulator (FSC). This means it has met the standards set by these regulators for financial safety and transparency.

HFM broker also holds client funds in segregated accounts, which means that your money is kept separate from the company’s funds. This provides an additional layer of protection in case the company goes bankrupt.

In addition, HFM is audited by Deloitte, a leading accounting firm. Your account statements are regularly reviewed to ensure they are accurate and transparent.

Of course, no broker is completely risk-free. There is always the potential to lose money when trading. However, HFM has taken steps to mitigate the risks involved in trading and is considered a safe and reliable broker. Open an Account right now – Click Here

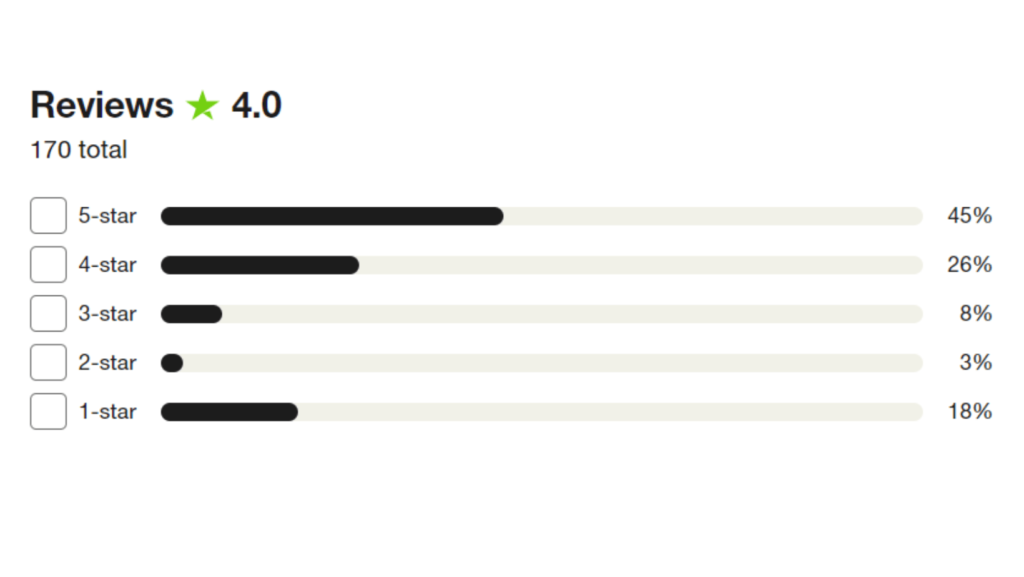

Latest HFM customers’ review 2023

Year Founded : 2010

Cryptocurrencies: (5+) Bitcoin, Litecoin, Ethereum

Deposit Methods: Local Deposit, Bank Wire (BankTransfer), VISA, MasterCard, Neteller, Skrill, WM, PM, Crypto, USDT (MORE)

HFM broker Trading Account types

HFM broker provides a range of four account types, surpassing the offerings of many other brokers. Its Micro Account has a remarkably low minimum deposit, making it an ideal choice for beginners venturing into trading. On the other hand, the ZERO Spread Account is specifically designed to meet the needs of seasoned traders seeking more advanced trading options.

PREMIUM

- Minimum deposit: $0

- Maximum Leverage: 1:2000 *

- Spreads Types: Variable

- Spreads from (pips): From 1.2 pip

- Max Simultaneous Open Orders: 500

PRO

- Minimum deposit: $100

- Maximum Leverage: 1:2000

- Spreads Types: Variable

- Spreads from (pips): From 0.5 pip

- Max Simultaneous Open Orders: 500

ZERO

- Minimum deposit: $100

- Maximum Leverage: 1:2000

- Spreads Types: Variable

- Spreads from (pips): From 0 on Forex and Gold

- Max Simultaneous Open Orders(*): 500 / (*)60 Standard lots per position

CENT

- Minimum deposit: $0

- Maximum Leverage: 1:2000

- Spreads Types: Variable

- Spreads from (pips): From 1.2 pip

- Max Simultaneous Open Orders: 150

Opening an Account at HFM (formerly known as HotForex)

Opening an account at HFM broker is a relatively swift and straightforward process. However, it took approximately two days more than some comparable brokers for our accounts to undergo verification. Open an Account right now – Click Here

The initial account setup at HFM was completed within three minutes, allowing us to deposit funds promptly. However, it took two more days for our accounts to be fully ready for trading.

Bangladesh has the opportunity to open an account at HFM, provided they meet the specified minimum deposit requirements:

Micro Account: 5 USD

ZERO Spread: 200 USD

Premium Account: 100 USD

HFcopy Account: 100 USD

We discovered that opening a live account at HFM was a straightforward process that could be accomplished in less than three minutes. While HFM broker also offers Corporate and Joint Accounts, we focused on opening an Individual Account.

To begin, we were required to provide our country of residence, phone number, full name, email address, date of birth, and password.

- Upon completing this step, we accessed our MyHF dashboard, an administrative hub encompassing demo accounts, live accounts, and financial information.

- From the MyHF dashboard, we selected our desired account type and submitted the necessary Know Your Customer (KYC) documentation. HFM broker requested a minimum of two documents to verify our identity as individual clients:

- Proof of Identification: A current colored scanned copy (in PDF or JPG format) of a passport or a similar identification document with a photo, such as an ID card or driver’s license.

- Proof of Address: A Bank Statement or Utility Bill. The provided documents should be at most six months and must display your name and physical address.

- It’s worth noting that the name on the Proof of Identification document must match the name on the Proof of Address document.

- We could directly upload our documents through the myHF area, although scanning and emailing them to backoffice.za@hfm.com was also acceptable.

- Additionally, we were required to complete a brief form that assessed our financial status and trading knowledge. While this step may not be present in the account-opening process of most brokers, it demonstrates HFM’s commitment to responsible consumer protection, a commendable approach in the industry.

Once these steps were fulfilled, we made the minimum required deposit for our chosen account type, utilizing one of HFM’s deposit methods.

Our submitted documents underwent a verification process by the dedicated department and were approved within approximately 48 hours, which is longer than some similar brokers may require.

It’s important to note that any deposits made will only be credited to the account after document approval and full activation of the myHF area.

We recommend thoroughly reading HFM’s risk disclosure, customer agreement, and business terms before initiating trading activities.

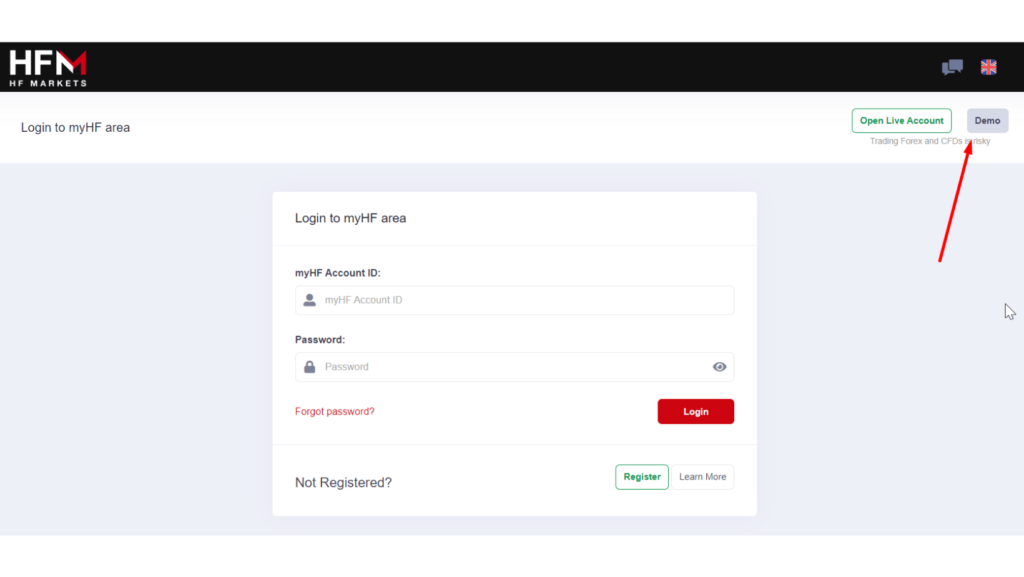

HFM broker offers a demo account, allowing you to practice trading without risking real money. The demo account is funded with virtual funds, so you can trade as if using real money. This is a great way to learn how to trade and test different strategies.

To open a demo account with HFM, you must create an account on their website. Once you have created an account, you can log in and select the “Demo Account” option. You will then be able to choose the type of demo account that you want to open. Open an Account right now – Click Here

HFM demo Account

HFM broker offers a demo account, allowing you to practice trading without risking real money. The demo account is funded with virtual funds, so you can trade as if using real money. This is a great way to learn how to trade and test different strategies.

To open a demo account with HFM, you must create an account on their website. Once you have created an account, you can log in and select the “Demo Account” option. You will then be able to choose the type of demo account that you want to open.

HFM offers two types of demo accounts:

Standard Demo Account: This is the basic demo account that offers all of the features of the live trading account. Open an Account right now – Click Here

VIP Demo Account: This more advanced demo account offers additional features, such as access to the HFM trading simulator.

Once you have chosen the type of demo account that you want to open, you will need to fund it with virtual funds. You can do this by depositing real money into your account or using the virtual funds already in your account.

Once you have funded your demo account, you can start trading. You can trade any of the assets available on the HFM trading platform. You can also use all the trading features available on the live trading platform.

The HFM demo account is a great way to learn how to trade and test different trading strategies. It is a safe and risk-free way to get started with trading.

Here are some of the benefits of using an HFM demo account:

- You can practice trading without risking any real money.

- You can learn how to use the HFM trading platform.

- You can test out different trading strategies.

- You can get a feel for the markets before trading with real money.

If you are interested in trading with HFM, consider opening a demo account first. This will allow you to learn how to trade and test out different trading strategies without risking any real money. Open an Account right now – Click Here

Year Founded : 2010

Cryptocurrencies: (5+) Bitcoin, Litecoin, Ethereum

Deposit Methods: Local Deposit, Bank Wire (BankTransfer), VISA, MasterCard, Neteller, Skrill, WM, PM, Crypto, USDT (MORE)

HFM Research and Trading Tools

HFM Broker offers a wide range of research and trading tools, including:

- Forex News: HFM partners with FXSTREET to provide a constant market news stream, including geopolitical events, macroeconomic movements, and technical analysis.

- HFAnalysis: This is HFM’s market research blog, which features monthly and quarterly outlooks, video analysis, special reports, and intraday charts.

- Advanced Insights: This plugin for MT4 and MT5 provides sentiment and volatility analysis from an insight engine that applies big data AI to millions of news articles and live trading positions.

- Autochartist: This award-winning automated technical analysis tool scans all available CFD markets for trading opportunities.

- VPS: HFM clients with a minimum deposit of 5000 USD can subscribe to a free VPS hosting service.

- Premium Trader Tools: This package gives traders access to institutional quality technology, including advanced trading tools, user-configurable news and information, and trade analysis.

We found that HFM’s research and trading tools are comprehensive and high-quality. The market news is timely and informative, the analysis is insightful, and the trading tools are powerful. However, we were disappointed that some tools are only available to traders with a minimum deposit.

Overall, HFM’s research and trading tools are a valuable resource for traders of all levels.

Here are some of the key strengths of HFM’s research and trading tools:

- A comprehensive range of tools

- High-quality market news

- Insightful analysis

- Powerful trading tools

Here are some of the limitations of HFM’s research and trading tools:

- Some tools are only available to traders with a minimum deposit

- The tools can be complex and difficult to use

Overall, HFM’s research and trading tools are a valuable resource for traders of all levels. However, we recommend that traders research before choosing which tools to use. Open an Account right now – Click Here

HRM FAQ

Is HFM a regulated broker?

Yes, HFM is a regulated broker. It is authorized and regulated by the following financial authorities:

- Financial Conduct Authority (FCA) in the United Kingdom

- Financial Services Commission (FSC) of the Republic of Mauritius

- Capital Markets Authority (CMA) in the Republic of Kenya

- Dubai Financial Services Authority (DFSA) in the United Arab Emirates

- Cyprus Securities and Exchange Commission (CySEC)

Does HFM have a withdrawal fee?

No, HFM broker does not charge any fees on withdrawal requests. However, the sending, correspondent and receiving bank may charge a withdrawal transfer fee. The fee amount will vary depending on the bank and the payment method. Open an Account right now – Click Here

Name

Details

Rating

Year Founded : 2010

Cryptocurrencies: (5+) Bitcoin, Litecoin, Ethereum

Deposit Methods: Local Deposit, Bank Wire (BankTransfer), VISA, MasterCard, Neteller, Skrill, WM, PM, Crypto, USDT (MORE)

Regulation: CySEC, FCA, DFSA, FSCA, FSA, CMA

Founded: 2008

Founders: Petr Valov, Igor Lychagov

Year Founded : 2008

Deposit Methods: VISA, MasterCard, Neteller, Skrill, WM, PM, Crypto (MORE)

Leverage: 1:30 | 1:500

Regulation: CySEC, FCA, DFSA, FSCA, FSA.

Min. Deposit: 5 US$

Min. Withdraw : 5 US$

HQ: Sydney, Australia

Platforms: MT4, MT5, ctrader, web trading

Found in: January 30, 2007

Deposit Methods: Bank Wire (BankTransfer), VISA, MasterCard, Neteller, Skrill, WM, PM, Crypto

Year Founded : 2010

Cryptocurrencies:

Yes

YesDeposit Methods: Local Deposit, Bank Wire (BankTransfer), VISA, MasterCard, Neteller, Skrill, WM, PM, Crypto, USDT

Year Founded : 2009

Cryptocurrencies:

Deposit Methods: Bank Wire (BankTransfer/SWIFT), VISA, MasterCard, Alipay, Bitcoin, Bitcoin Cash, Boleto, Ether/Ethereum, Litecoin, Local Bank Deposits, M-Pesa, Mobile Money, Monero, PerfectMoney, Ripple, WebMoney

Year Founded : 2009

Cryptocurrencies:

Deposit Methods: Local Deposit, Bank Wire (BankTransfer), VISA, MasterCard, Neteller, Skrill, WM, PM, Crypto, USDT

Year Founded : 2009

Cryptocurrencies:

Deposit Methods: Bank Wire (BankTransfer/SWIFT), VISA, MasterCard, Alipay, Bitcoin, Bitcoin Cash, Boleto, Ether/Ethereum, Litecoin, Local Bank Deposits, Mobile Money, PerfectMoney, WebMoney, USDT

Year Founded : 2011

Cryptocurrencies: (25+) Bitcoin, Litecoin, Ethereum

Deposit Methods: Bank Deposit, VISA, awepay, Bitcoin, FasaPay, Local Bank Deposits, Local Bank Transfers, Neteller, paytm, Skrill, UnionPay, USDT

Leverage: 1:20 | 1:500

Regulation: CySEC, FCA, DFSA, FSCA, FSA.

Min. Deposit: 50 US$

Min. Withdraw : 50 US$

HQ: Australia, Cyprus, and the UK.

Platforms: MT4, cTrader, web trading

EAs/Robots: ✅ Yes | News Trading: ✅ Yes | Scalping: ✅ Yes

Cryptocurrencies: 20+) Bitcoin, Litecoin, Ethereum

Deposit Methods: Local Deposit, Bank Wire (BankTransfer), VISA, MasterCard, Neteller, Skrill, Crypto. USDT

Leverage: 1:20 | 1:500

Regulation: CySEC, FCA, DFSA, FSCA, FSA.

Min. Deposit: 100 US$

Min. Withdraw : 100 US$

HQ: Cyprus, the UK, Australia, and the United States.

Platforms: MT4, cTrader, web trading

EAs/Robots: ✅ Yes | News Trading: ✅ Yes | Scalping: ✅ Yes

Cryptocurrencies: 20+) Bitcoin, Litecoin, Ethereum

Deposit Methods: Local Deposit, Bank Wire (BankTransfer), VISA, MasterCard, Neteller, Skrill, Crypto. USDT

Leverage: 1:20 | 1:500

Regulation: CySEC, FCA, DFSA, FSCA, FSA.

Min. Deposit: 50 US$

Min. Withdraw : 50 US$

HQ: Australia, Cyprus, and the UK.

Platforms: MT4, cTrader, web trading

EAs/Robots: ✅ Yes | News Trading: ✅ Yes | Scalping: ✅ Yes

Cryptocurrencies: 20+) Bitcoin, Litecoin, Ethereum

Deposit Methods: Local Deposit, Bank Wire (BankTransfer), VISA, MasterCard, Neteller, Skrill, Crypto. USDT

Year Founded : 2010

Cryptocurrencies:

Deposit Methods: Local Deposit, Bank Wire (BankTransfer), VISA, MasterCard, Neteller, Skrill, WM, PM, Crypto, USDT

A Forex broker is a financial services company that provides traders with access to the foreign exchange market. The primary function of a Forex broker is to facilitate the buying and selling of currencies by acting as an intermediary between the trader and the market ( Forex BD / BD Forex / ForexBD / ForexBDLTD / Forex bd LTD / @forexbd )..

Forex brokers offer traders a variety of services, including trading platforms, market analysis, and educational resources. They also provide access to leverage, which allows traders to control larger positions with a smaller amount of capital.

Forex brokers can operate in different ways, such as market makers, which set their own bid and ask prices and take the opposite side of their clients’ trades, or as agency brokers, which pass their clients’ orders directly to the market without any intervention.

Choosing a reliable and trustworthy Forex broker is important for traders to ensure that they receive fair and transparent pricing, access to a range of financial instruments, and adequate customer support ( Forex BD / BD Forex / ForexBD / ForexBDLTD / Forex bd LTD / @forexbd )..

Forex brokers play an important role in the foreign exchange market by providing liquidity and enabling traders to participate in the market with ease. Forex brokers offer a wide range of services and tools to traders, including:

Trading Platforms: Forex brokers provide traders with access to trading platforms that allow them to place trades, analyze the market, and manage their trading accounts.

Market Analysis: Forex brokers offer traders access to market analysis, including news, research, and economic data. This can help traders make informed decisions about when to enter or exit the market.

Educational Resources: Forex brokers often provide educational resources, such as webinars, videos, and tutorials, to help traders improve their trading skills and knowledge.

Leverage: Forex brokers offer traders access to leverage, which allows traders to control larger positions with a smaller amount of capital. However, it’s important to note that leverage can increase both potential profits and losses.

Customer Support: Forex brokers provide customer support to help traders with any questions or issues they may have ( Forex BD / BD Forex / ForexBD / ForexBDLTD / Forex bd LTD / @forexbd )..

When choosing a Forex broker, traders should consider factors such as the broker’s reputation, regulation, trading conditions, fees and commissions, and customer support. It’s important to choose a broker that is reliable, transparent, and offers competitive pricing and trading conditions.

Forex brokers provide traders with access to various types of trading platforms, each with its own unique features and advantages. Here are some of the most common types of Forex broker platforms:

MetaTrader 4 (MT4): MT4 is one of the most popular Forex trading platforms, used by millions of traders worldwide. It is known for its user-friendly interface, extensive charting tools, and support for automated trading through Expert Advisors (EAs) ( Forex BD / BD Forex / ForexBD / ForexBDLTD / Forex bd LTD / @forexbd )..

MetaTrader 5 (MT5): MT5 is the newer version of MT4 and offers additional features and improvements, such as more advanced charting tools, additional order types, and support for more financial instruments.

cTrader: cTrader is a trading platform that offers advanced charting tools, support for automated trading, and fast order execution. It is known for its user-friendly interface and customization options.

WebTrader: WebTrader is a browser-based trading platform that allows traders to access the market from any device with an internet connection. It is a popular choice for traders who prefer a simple and easy-to-use platform ( Forex BD / BD Forex / ForexBD / ForexBDLTD / Forex bd LTD / @forexbd )..

Mobile Trading Platforms: Forex brokers also offer mobile trading platforms that allow traders to access the market and manage their positions from their smartphones or tablets. These platforms typically offer a range of features, including real-time quotes, charts, and news updates.

When choosing a Forex broker platform, it’s important to consider factors such as ease of use, charting tools, order types, automated trading options, customization options, and compatibility with your trading style and strategy. Ultimately, the best platform for you will depend on your individual needs and preferences as a trader.

Forex brokers can be categorized into different types based on their business model and the services they offer to their clients. Here are some of the most common types of Forex brokers ( Forex BD / BD Forex / ForexBD / ForexBDLTD / Forex bd LTD / @forexbd ). :

Dealing Desk (DD) Brokers: Dealing Desk brokers, also known as market makers, act as counterparties to their clients’ trades. They provide liquidity to the market by taking the opposite side of their clients’ trades, and may also offer fixed spreads, guaranteed stop-loss orders, and other risk management tools.

No Dealing Desk (NDD) Brokers: No Dealing Desk brokers do not act as counterparties to their clients’ trades, but instead route their orders directly to liquidity providers, such as banks, financial institutions, and other brokers. NDD brokers typically offer variable spreads and faster order execution speeds than DD brokers.

Electronic Communication Network (ECN) Brokers: ECN brokers are similar to NDD brokers, but instead of routing orders to a single liquidity provider, they connect their clients to a network of liquidity providers, which compete to offer the best bid and ask prices. ECN brokers typically charge a commission for their services, but offer some of the tightest spreads and fastest order execution speeds in the market.

Straight Through Processing (STP) Brokers: STP brokers are similar to NDD brokers, but instead of routing orders directly to liquidity providers, they use automated systems to execute orders based on pre-defined trading rules. STP brokers may offer variable or fixed spreads, and may charge a commission or markup on their services.

Hybrid Brokers: Hybrid brokers combine elements of different business models, such as acting as both a market maker and an ECN broker, or offering both fixed and variable spreads. Hybrid brokers may offer a range of services and account types to meet the needs of different types of traders.

When choosing a Forex broker, it’s important to consider the broker’s business model and the services they offer, as well as their reputation, regulation, and customer support. The best broker for you will depend on your individual needs and trading style, as well as the trading conditions and fees offered by the broker.

Forex trading is a popular financial activity that involves buying and selling currencies to profit from the fluctuations in exchange rates. As with any financial activity, it is essential to choose a reputable and regulated broker to ensure the safety of your funds and a fair trading environment. In this article, we will discuss some of the top regulated forex broker houses.

Online forex trading payment methods refer to the various payment options available for forex traders to deposit or withdraw funds from their trading accounts. In the world of forex trading, payment methods play a vital role in facilitating smooth transactions, and it is important to choose a secure and reliable payment method that suits your needs.

Like, Share & Subscribe to Our Official Sites

Contact with Us :

Copyright © 2023 Forex BD

Risk Warning: Trading on financial markets carries risks. Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high level of risk since leverage can work both to your advantage and disadvantage. As a result, CFDs may not be suitable for all investors because you may lose all your invested capital. You should not risk more than you are prepared to lose. Before deciding to trade, you need to ensure that you understand the risks involved and take into account your investment objectives and level of experience.

Disclaimer : Forexbd.ltd is not encouraging anyone to do forex/stock trading, as there are investments and financial risks involved. ForexBD channel or videos are educational and informative. Before deciding to invest in the forex market, you should carefully consider your investment objectives, level of experience, and risk appetite.

#ForexTrading #ForexMarket #ForexBroker #ForexSignals #ForexAnalysis #ForexEducation #ForexPlatform #ForexTools #ForexStrategy #ForexTradingTips #ForexInvesting #ForexNews #CurrencyTrading #OnlineTrading #TradingSoftware #TechnicalAnalysis #FundamentalAnalysis #RiskManagement #MarketResearch #TradingCommunity #ForexTradingSignals #ForexTradingSystem #ForexMarketAnalysis #ForexMarketNews #ForexMarketResearch #ForexTradingStrategies #ForexTrader #ForexTradingSoftware #ForexTradingCourse #ForexTradingForBeginners #ForexTradingPlatform #ForexTradingEducation #ForexTradingAcademy #ForexTradingOnline #ForexTradingCommunity #ForexTradingCharts #ForexTradingIndicators #ForexTradingAccount #ForexTradingCoach #ForexTradingRobot